Bitcoin is expected to hit $159K. It is possible, but only if…

Bitcoin’s Cycles Are Changing, But Its Strength Remains

Over the past eight years, Bitcoin (BTC) has undergone a major transformation in price behavior as the market matures. While the cryptocurrency still experiences bullish cycles, the peaks of these cycles have steadily declined from 15× to just 2.65× the 2-Year Simple Moving Average (2Y SMA).

Lower Cycle Multiples, Stronger Market Structure

Although cycle multiples are decreasing, Bitcoin is demonstrating signs of structural strength. The market has evolved from wild speculative rallies into a more stable ecosystem, attracting a broader base of investors.

From Explosive Rallies to Tempered Surges

In Bitcoin’s early days, bull runs were extremely volatile, with cycle tops hitting 15× the 2Y SMA, according to Alphractal data. These massive upswings reflected a thin market and early-adopter-driven speculation, leading to sharp, unpredictable price swings.

Over time, BTC’s peaks relative to its 2Y SMA have shrunk, signaling that the market is becoming less volatile but more resilient.

What This Means for Bitcoin Investors

-

Lower multiples suggest a maturing market with fewer extreme swings.

-

Structural strength indicates Bitcoin is increasingly resilient to shocks.

-

Long-term investors can expect a more predictable and stable growth pattern compared to early explosive cycles.

Bitcoin’s journey shows that even as its cycle tops moderate, the underlying strength of the network and market fundamentals continue to support long-term growth.

Bitcoin’s Evolution: From Wild Rallies to Macro Asset Status

Since 2017, Bitcoin’s market dynamics have been changing dramatically. As BTC entered the global consciousness, its growth, though impressive, became more tempered.

During this period, cycle tops occurred around 10× the 2-Year Simple Moving Average (2Y SMA), reflecting high volatility amid a maturing market.

Institutional Influx and Structural Shift

By 2021, institutional capital flooded into Bitcoin, yet the cycle peak dropped to 5× and later 2.65× the 2Y SMA.

This was a major structural shift: Bitcoin was no longer just a speculative trade—it was emerging as a macro asset with deeper liquidity and growing adoption.

2.65× the 2Y SMA: The Next Resistance at $159K

In the most recent cycle, BTC has struggled to surpass the 2.65× multiple, signaling narrower gains and a more mature asset profile.

-

Currently, the 2Y SMA × 2.65 level sits around $159,000, representing lower volatility, stronger liquidity, and a mature user base.

-

If Bitcoin makes a major upswing, $159K could act as the next key resistance.

Room for Growth Remains

Despite diminishing cycle tops, Bitcoin still has potential for growth:

-

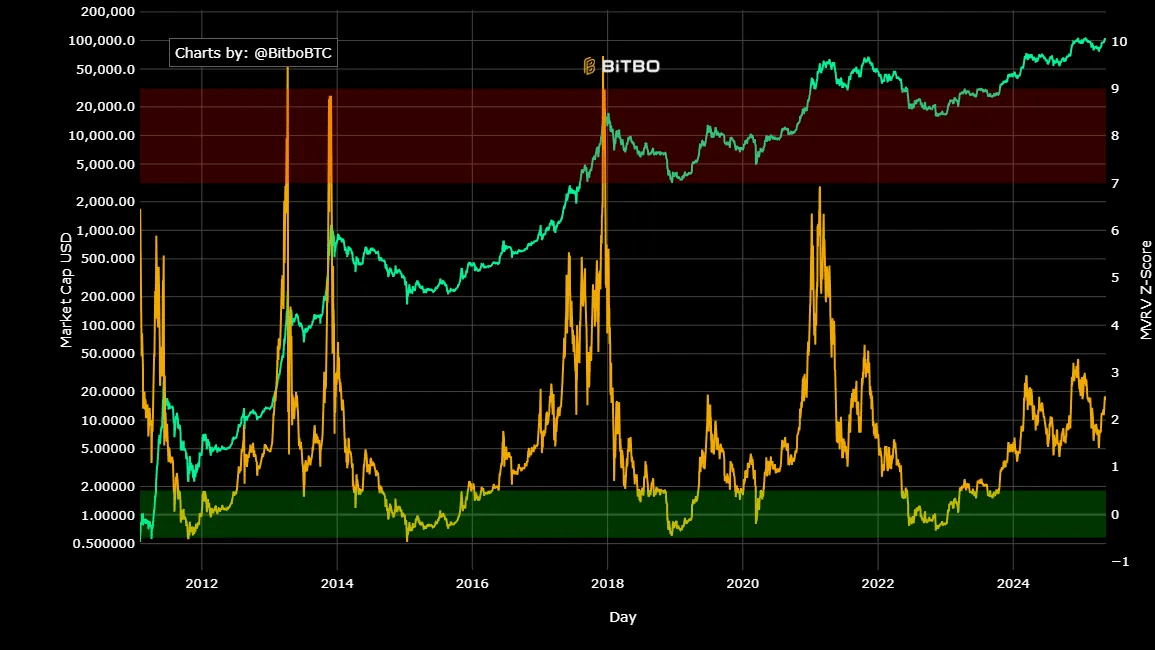

MVRV ratio is around 2.4, indicating the market is below euphoria levels.

-

Historically, BTC cycle tops have occurred between 3.5× and 4.0× MVRV, suggesting more room before the next peak.

Bitcoin’s journey shows a clear transition: from volatile early rallies to a mature macro asset, with $159K acting as the next critical milestone for long-term investors.

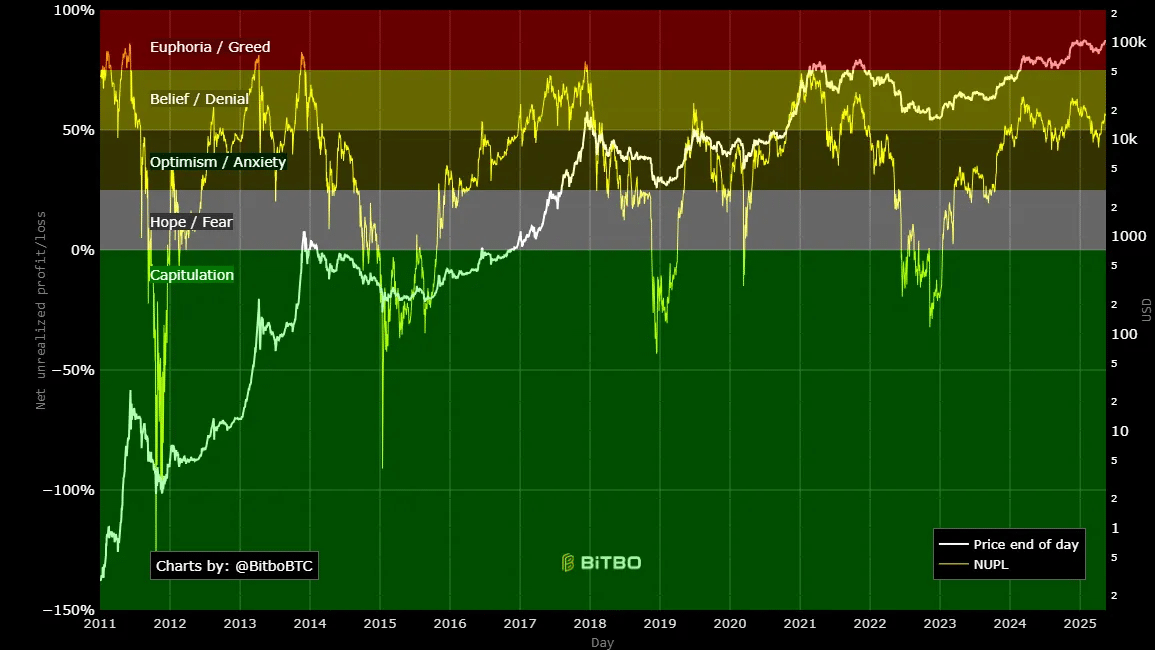

Furthermore, NUPL (Net Unrealized Profit/Loss) is still in the belief/denial zone rather than the euphoric or greedy zone.

BTC holders are currently unlikely to pursue aggressive profit-taking since they anticipate higher prices for the current cycle due to the great maturity of market behavior.

The bottom line

Consequently, there is still more potential for growth, where Bitcoin is more stable, less volatile, and dependable as an investment, even though future cycles can no longer see a 15x spike.

Bitcoin still has room to expand in the current market. We might witness a spike to $159k levels if the cycle’s momentum continues and Bitcoin hits $110k.

Although this is unlikely in the near future, this level may be where markets cool down for the present cycle because the market has not yet reached a peak.